Mortgage Claims & Advice Review: Safeguard Yourself Against Deceptive Practices

Is Mortgage Claims & Advice a Reliable Broker or a Potential Risk?

If you are considering trading with MortgageClaimAdvice.org, it is essential to be aware of the issues associated with this platform. Numerous reports have surfaced questioning Mortgage Claims & Advice’s reliability and transparency. This Mortgage Claims & Advice review aims to shed light on potential risks, offer guidance for those who have encountered challenges, and help those who are seeking help recovering lost funds.

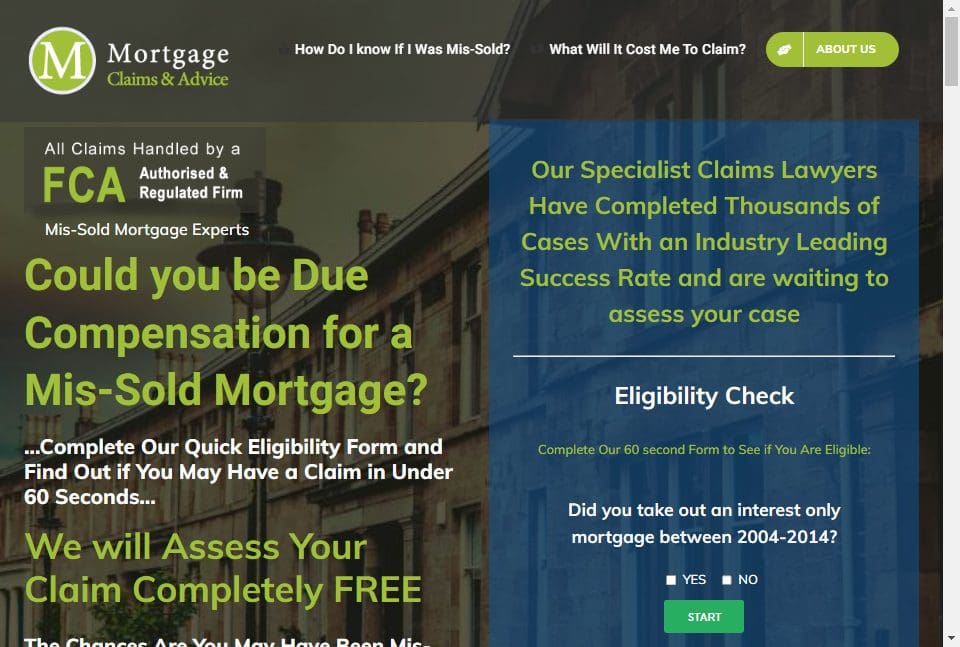

Mortgage Claims & Advice Website – www.mortgageclaimadvice.org

Website Availability – YES

Address – NA

Warning – Financial Conduct Authority (United Kingdom)

Domain Age –

Name: mortgageclaimadvice.org

Registry Domain ID: af069e7164654382b806ec8fb975ed76-LROR

Registered On: 2020-04-20T23:05:03.943Z

Expires On: 2025-04-20T23:05:03.943Z

Updated On: 2024-04-25T02:37:14.516Z

Mortgage Claims & Advice has received bad comments from users, citing a number of concerns. The website’s structure is noticeably bad, making navigation difficult and information hard to find. Crucial information regarding the firm’s background, credentials, and regulatory status is noticeably omitted, leaving potential clients unsure who they are working with. Worryingly, the Financial Conduct Authority (FCA) has issued warnings about illegal claims management firms (CMCs) that target mortgage holders by demanding fees with promises of debt write-offs or compensation. Engaging with such unlicensed organizations exposes consumers to enormous financial risks, including upfront costs, with no promise of success.

Scam Allegations and Complaints

This section will explore various scam allegations and complaints that have surfaced about MortgageClaimAdvice.org Broker. These issues have raised red flags for many potential and current users, prompting a deeper investigation into the company’s practices.

Customer Complaints

Numerous customers have reported negative experiences with Mortgage Claims & Advice Broker, particularly around the handling of their accounts and funds. Common complaints include:

- Unfulfilled Withdrawals: Users have frequently expressed frustration with delays or outright denials when trying to withdraw their funds. Many report that after submitting withdrawal requests, they face long waiting periods with no clear communication from the broker.

- Hidden Fees: Some customers allege that Mortgage Claims & Advice Broker imposes unexpected fees that were not clearly outlined at the time of signing up. These fees often eat into profits or even the principal amount, leaving users with significantly less than anticipated.

Regulatory Issues

Mortgage Claims & Advice Broker’s standing with regulatory authorities has been questioned multiple times. In some cases, financial regulators have issued warnings about the company, advising the public to exercise caution. The broker’s licensing status might also be unclear or non-existent, which is a significant concern for those considering investing through their platform.

- Unlicensed Operations: Several allegations suggest that Mortgage Claims & Advice Broker is operating without proper licensing or has been banned in certain jurisdictions.

- Regulatory Warnings: There have been instances where regulatory bodies from various countries have blacklisted or issued alerts against MortgageClaimAdvice.org Broker, warning consumers of potential fraudulent activities.

Red Flags

Potential red flags have been pointed out by users and industry observers alike, which further fuel the scam allegations:

- Lack of Transparency: Mortgage Claims & Advice Broker has been accused of being opaque about its operations, including the actual identities of the individuals running the company.

- Aggressive Sales Tactics: Reports suggest that Mortgage Claims & Advice Broker employs high-pressure sales tactics to push clients into making larger deposits. This includes constant follow-ups, unrealistic promises of high returns, and reluctance to take ‘no’ for an answer.

Don’t let deceptive practices hold you back. Contact Lycan Retrieve today for a free case evaluation and expert assistance.

Before investing, always research the broker thoroughly. Reviews and complaints often provide critical insights into the practices of platforms like Mortgage Claims & Advice.

Protect Yourself from Potential Financial Losses

To avoid falling victim to deceptive schemes, follow these precautions:

- Do Extensive Research: Examine the broker’s history, adherence to regulations, and client testimonials.

- Verify Licensing: Ensure the broker is registered with a recognized financial authority.

- Stay Skeptical: Be cautious of promises of high returns or risk-free investments.

- Stay Alert: Monitor the market and stay informed about potential fraudulent schemes.

If you’ve already faced challenges with Mortgage Claims & Advice, take immediate steps to report the issue and seek professional assistance.

Recover Lost Funds with Expert Help

Victims of Mortgage Claims & Advice’s alleged deceptive practices often feel helpless, but there are effective steps you can take to address the situation:

- File a Complaint: Reporting your experience can help alert others and initiate action against such practices.

- Seek Professional Guidance: Contact us for expert support in navigating the chargeback process and recovering your funds.

- Learn from the Experience: Conduct thorough research before investing with any broker to avoid similar situations in the future.

Our specialty at Lycan Retrieve is offering dependable, quick recovery services to help you get back your lost property.

Why Choose Expert Assistance for Mortgage Claims & Advice Fund Recovery?

Recovering funds from deceptive brokers like Mortgage Claims & Advice can be complex, but professional assistance can streamline the process. Our team specializes in helping victims of such practices by:

- Assessing your situation and gathering evidence.

- Initiate a chargeback process with your payment provider.

- Guiding you through regulatory and legal procedures to strengthen your case.

Working with professionals improves your chances of getting back money that has been lost and shields you from wrongdoing in the future.

Take Action Today

Do not hesitate to act if you believe Mortgage Claims & Advice has deceived you. Contact us for a free consultation to find out more about your options and start the recovery process. Protecting your financial interests starts with being proactive and knowledgeable.

Remember, at Lycan Retrieve, we build trust, recover losses, and deliver results. Allow us to assist you in receiving your money back.

Contact us right now to safeguard your future and take back financial control.

Visit Lycan Retrieve Facebook Page

Visit Twitter

No comment