In this Solal Capital review, we delve into the operations and claims of a brokerage firm that has garnered attention for its promises of high returns and a wide range of investment opportunities. Despite its alluring marketing, several red flags and user experiences raise questions about its credibility.

Solal Capital Overview

Website: https://www.solal.capital/

Website Availability: No

Address: 20-22 Wenlock Road London N17GU United Kingdom

Regulation: Unregulated

Warning: Securities and Exchange Commission (USA)

Domain Age:

- Domain Name: solal.capital

- Registry Domain ID: c9170590d94d48279a899c6f3f35ccff-DONUTS

- Registrar WHOIS Server: whois.namecheap.com

- Registrar URL: https://www.namecheap.com/

- Updated Date: 2023-10-21T12:05:45Z

- Creation Date: 2022-10-31T12:48:10Z

- Registry Expiry Date: 2024-10-31T12:48:10Z

Overview of Solal Capital

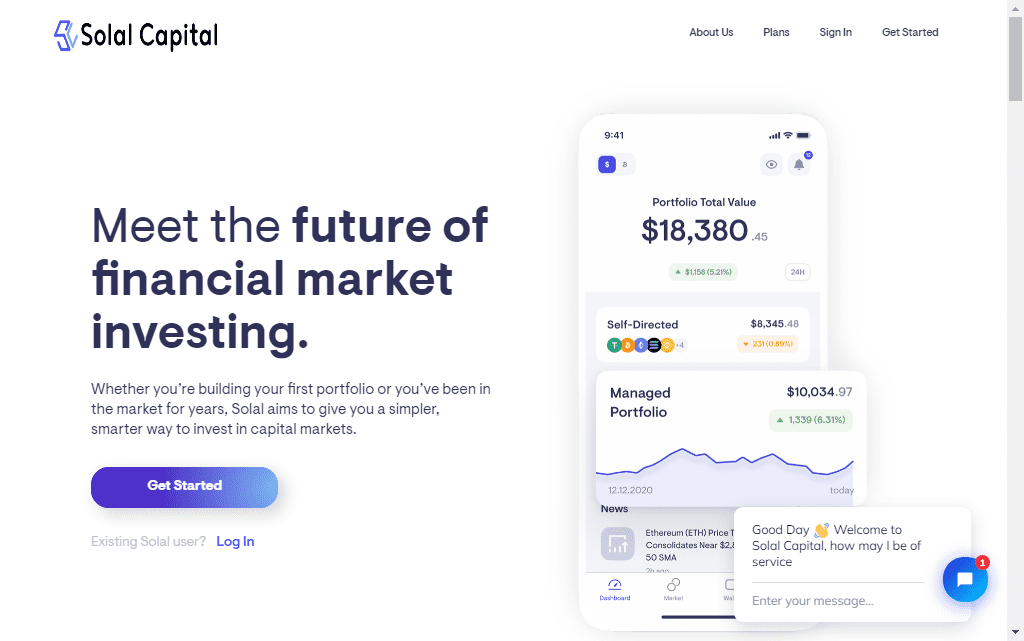

Solal Capital presents itself as a sophisticated brokerage firm claiming to be SEC-registered. It markets a variety of financial instruments, including:

- Stocks

- Commodities

- Forex

- Cryptocurrencies

Their website emphasizes the possibility of large returns, professional portfolio management, and sophisticated investment instruments. On the surface, this may appeal to both novice and seasoned investors who want to diversify their portfolios. However, as this Solal Capital review reveals, the promises made by the firm do not align with its operational realities.

Warning Signs of Solal Capital

Regulatory Issues and SEC Warning

One of the most alarming findings in this Solal Capital review is that the firm operates without proper regulation. Solal Capital claims to be registered with the SEC, yet the commission has explicitly flagged the company for unlicensed operations. According to the SEC, Solal Capital is not authorized to offer financial services in the U.S. or any other jurisdiction globally.

Warnings from reputable regulatory bodies like the SEC are critical indicators for investors. The SEC’s public notices serve to protect consumers from unregulated entities that may engage in fraudulent or deceptive practices. For Solal Capital to continue marketing itself as SEC-registered despite the warning is a serious red flag that undermines its credibility.

Website Issues and Credibility

The official website of Solal Capital, solal.capital, is non-functional. A functional website is often a basic requirement for any legitimate brokerage firm. The inaccessibility of their platform not only hampers communication but also undermines trust.

Moreover, while there are mixed Solal Capital reviews online, many of these reviews seem fabricated. Positive feedback often appears generic and lacks detailed experiences, which can indicate fake testimonials. This Solal Capital review emphasizes that relying on such unverifiable feedback can be misleading.

User Experiences

Several investors have shared their experiences with Solal Capital, shedding light on the potential pitfalls of dealing with the firm. One such account highlights the lack of adequate research before investing with Solal Capital. The user recounts:

“I didn’t do adequate research before I started dealing with them last year. I felt guilty for putting so much faith in them; when I tried to withdraw, I lost communication with them, and customer service never responded.”

This experience reflects common issues faced by individuals who have interacted with unregulated entities.

Why Regulation Matters in Investing

This Solal Capital review underscores the importance of investing with regulated entities. Licensed brokers are required to:

- Provide transparent terms and conditions.

- Keep customer funds in separate accounts.

- Follow stringent data protection and anti-money laundering guidelines.

Investors are exposed to financial losses and have few options when dealing with unregulated companies such as Solal Capital, which function without responsibility.

Identifying Fake Reviews

As mentioned earlier in this Solal Capital review, the firm’s online presence includes mixed reviews. However, a closer examination reveals that many positive testimonials lack credibility. Here’s how to identify potentially fake reviews:

- Generic Praise Without Details: Real reviews frequently include specific examples of customer experiences. Red flags include generalizations like “great service” or “high returns” that lack context.

- Overwhelmingly Positive Feedback: No financial service provider can satisfy all clients. A suspiciously high number of glowing reviews may indicate manipulation.

- Similar Language Across Reviews: If multiple reviews use identical phrases or wording, it suggests a coordinated effort to create fake feedback.

These patterns appear in the case of Solal Capital, further casting doubt on its legitimacy.

Solal Capital Review Conclusion

This Solal Capital review highlights numerous concerns surrounding the brokerage firm. From regulatory issues to withdrawal difficulties and fake reviews, multiple red flags cannot be ignored. While Solal Capital markets itself as a sophisticated investment platform, the lack of transparency and negative user experiences suggest otherwise.

Take Action Now: Recover Your Lost Funds with Lycan Retrieve

Have you been a victim of Binary Options, Forex, CFDs, Bitcoin trading, or other online fraudulent practices? Lycan Retrieve specializes in expert fund recovery services, offering professional support to help you reclaim your lost assets. Don’t let fear of loss or massive businesses hold you back—our skilled team can handle complex matters and assure the highest level of representation. With a focus on achieving successful outcomes, Lycan Retrieve stands ready to support you in your fight against deceptive trading operations. Start your journey toward financial recovery today!

Visit Lycan Retrieve Facebook Page

No comment