Pocket Option, operating under the trading name of Gembell Limited, presents itself as an online Forex and CFD broker established in 2017. With a unique array of offerings, including tradable financial instruments, a web-based trading platform, and seven user levels, it has attracted attention from traders worldwide. However, closer analysis reveals substantial problems regarding its legitimacy and reliability, which potential investors should consider before dealing with the platform. This Pocket Option review will thoroughly evaluate its operations, regulatory claims, platform features, and customer feedback.

Pocket Option Overview

Website: https://pocketoption.com

Website Availability: Yes

Address: C/O LC02 503, Choc Bay, Castries, Saint Lucia

Regulation: Unregulated

Warning: Financial Conduct Authority (United Kingdom), Financial Services and Markets Authority (Belgium), and Commodity Futures Trading Commission (United States)

Domain Age:

- Name pocketoption.com

- Registry Domain ID 2044881027_DOMAIN_COM-VRSN

- Registered On 2016-07-21T01:36:42Z

- Expires On 2028-07-21T01:36:42Z

- Updated On 2023-07-11T12:49:37Z

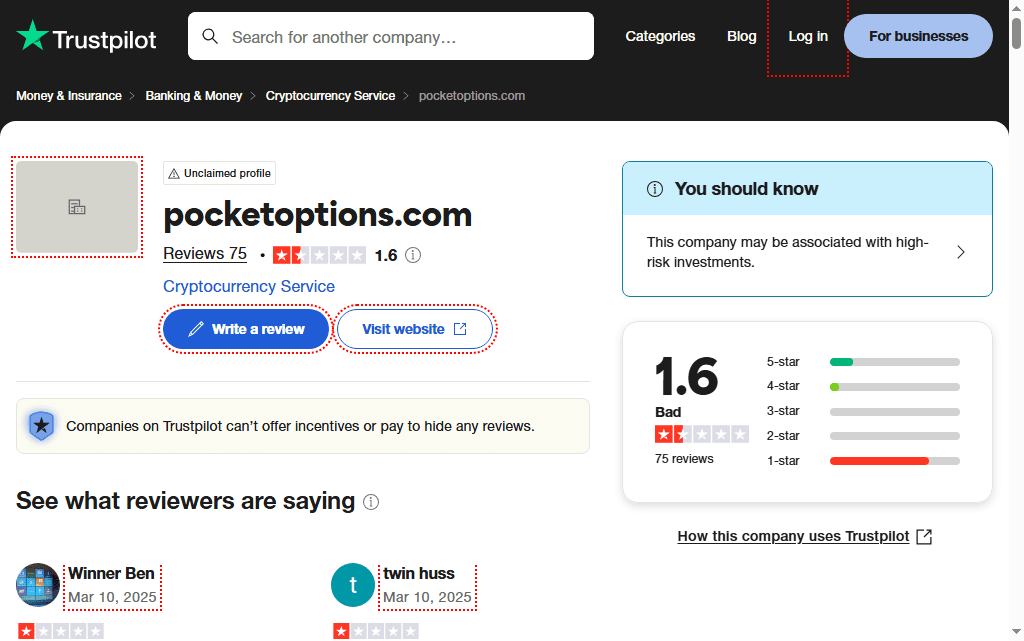

Negative Trustpilot Reviews

Many of these users have left negative reviews on Trustpilot, citing disappointment with their experience using this platform. The typical complaints include withdrawing issues, bad customer service, false advertising, and potential fraudulent activity. Though individual experiences can differ, the general Trustpilot rating invokes unease regarding the website’s legitimacy and credibility. It is advisable for prospective investors to review third-party feedback and use caution before financially committing.

Registration and Regulatory Concerns

According to Pocket Option, it is registered in the Marshall Islands under registration number 86967 and is regulated by the International Financial Market Relations Regulation Center (IFMRRC). However, both these claims warrant scrutiny:

Dissolved Registration

Records from the Marshall Islands Registry (IRI) reveal that Gembell Limited is no longer active, as the company is listed as dissolved.

Questionable Regulation

Although the IFMRRC is mentioned as a regulatory body, it does not oversee entities conducting Forex or CFD trading activities. This means that Pocket Option operates without any credible regulatory oversight.

Revoked License

Furthermore, Pocket Option claims that the Mwali International Services Authority (MISA) issued them a license. However, this license has been canceled, leaving the company unregulated.

The lack of valid regulatory oversight is a significant red flag, as reputable brokers are typically registered with recognized financial authorities like the FCA (UK), ASIC (Australia), or CySEC (Cyprus), ensuring investor protection and market integrity.

Trading Platform and Tools

Unlike many reputable brokers offering the MetaTrader 4 (MT4) or MetaTrader 5 (MT5) platforms, known for their robust charting tools, ease of use, and extensive customization, Pocket Option relies on a proprietary web-based trading platform. While a custom platform may seem unique, it often lacks the advanced features and reliability of industry-standard software. Many traders prefer MT4 and MT5 for their proven track record and compatibility with various trading strategies and tools.

This Pocket Option review finds that relying on a less robust platform could limit traders’ ability to analyze markets and execute trades effectively. If you’re considering trying the Pocket Option demo, be aware that demo accounts may not fully reflect the real market experience.

Additionally, traders using mobile platforms should note that the Pocket Option app is available, but its performance and reliability have received mixed reviews.

Negative User Feedback

The platform’s credibility is seriously questioned by traders’ Pocket Option reviews. Numerous reviews on platforms like Trustpilot suggest a pattern of unethical practices, including:

Withdrawal Issues

Many users complain about having trouble taking their money out. Complaints include outright rejections, prolonged delays, and requests for unnecessary verifications.

Platform Manipulation

Several traders allege sudden and suspicious market movements, particularly at the last moment, resulting in losses. This has fueled suspicions of price manipulation.

Unresponsive Customer Support

Users frequently mention that customer support is either unresponsive or fails to provide satisfactory resolutions to their issues.

One dissatisfied trader wrote:

“I deposited $300 and made a $300 profit, but my withdrawal request was rejected due to alleged verification problems. No response from customer support.”

Another reviewer stated:

“This platform is not legitimate. I lost €800 due to unexplained platform behavior. Avoid Pocket Option at all costs.”

Such recurring issues suggest systemic problems with the platform.

Regulatory Warnings

The Commodity Futures Trading Commission (CFTC) in the US, the Financial Conduct Authority (FCA) in the UK, and the Financial Services and Markets Authority (FSMA) in Belgium are among the financial regulators that have warned against Pocket Option. These warnings highlight the broker’s unauthorized status in their jurisdictions, signaling potential risks for traders.

Risks of Trading with Pocket Option

This Pocket Option review identifies several risks that make it a questionable choice:

- Lack of Oversight: The absence of valid regulatory licenses leaves traders vulnerable to unfair practices.

- Withdrawal Issues: Numerous reports of denied withdrawals raise concerns about the platform’s reliability.

- Unverified Claims: Pocket Option’s marketing promises are unsupported by evidence or transparency.

- Pocket Option minimum deposit: While the platform advertises low minimum deposits, users have reported difficulties in withdrawing funds, even after making successful deposits.

Pocket Option Review Conclusion

This Pocket Option review exposes numerous red flags surrounding the broker’s operations. Its dissolved registration, lack of regulatory oversight, and widespread customer complaints make it a highly unreliable choice for traders. While its web-based platform and gamified user levels may appeal to beginners, the risks associated with the platform far outweigh any potential benefits.

Take Action Now: Recover Your Lost Funds with Lycan Retrieve

Have you been a victim of Binary Options, Forex, CFDs, Bitcoin trading, or other online fraudulent practices? Lycan Retrieve specializes in expert fund recovery services, offering professional support to help you reclaim your lost assets. Don’t let fear of loss or massive businesses hold you back—our skilled team can handle complex matters and assure the highest level of representation. With a focus on achieving successful outcomes, Lycan Retrieve stands ready to support you in your fight against deceptive trading operations. Start your journey toward financial recovery today!

Visit Lycan Retrieve Facebook Page

No comment