In this HighLow review, we take a close look at HighLow to uncover the issues it has been facing, based on real user feedback, and explore why it might be considered a high-risk choice for online traders.

Lack of Transparency

The biggest flaw with HighLow is a lack of openness. Many users claim difficulty obtaining precise information about the broker, such as its regulatory status or the specific services it provides. The website itself frequently appears incomplete or ambiguous, making it difficult for traders to make informed selections before depositing their funds.

Website Unavailability

Several traders have expressed annoyance with the HighLow website’s occasional unavailability. The platform has had occasional outages and difficulties, making it impossible for users to access their accounts or complete transactions. These technical challenges not only disrupt trade but also raise questions about the broker’s capacity to operate a secure and stable platform.

Regulatory Concerns

Moreover, there are serious regulatory concerns surrounding HighLow. Legitimate brokers are typically regulated by financial authorities in key regions, but HighLow has failed to provide clear evidence of its compliance with major regulatory bodies. This lack of regulatory oversight leaves traders vulnerable to potential scam or unfair practices.

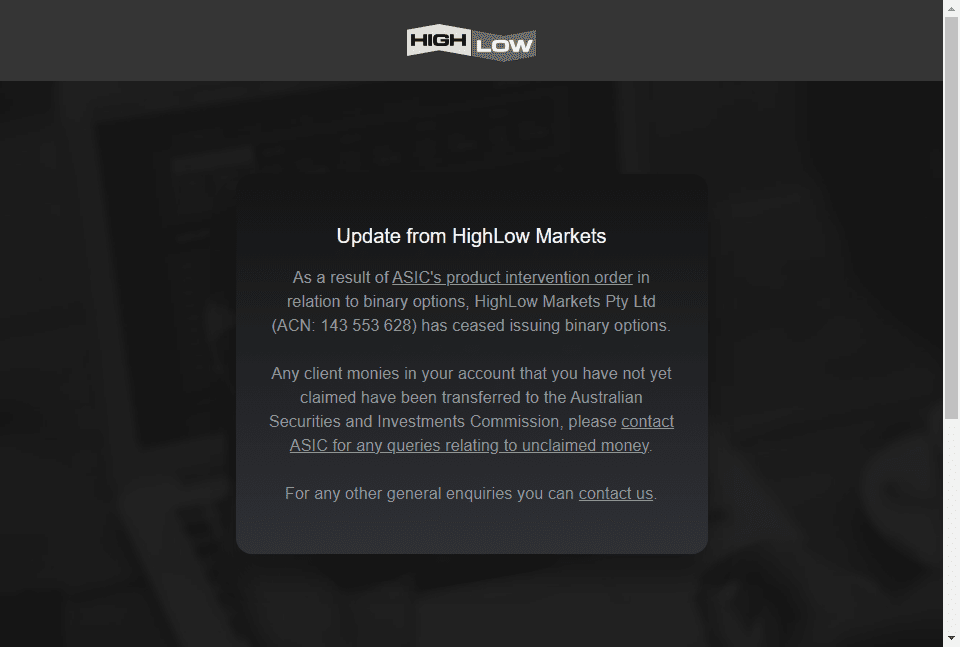

ASIC’s Product Intervention Order

Its website is showing a message due to the Australian Securities and Investments Commission’s (ASIC) product intervention order concerning binary options, HighLow Markets Pty Ltd (ACN: 143 553 628) has stopped offering binary options. Any unclaimed client funds in your account have been transferred to ASIC. For any questions or to claim unclaimed funds, please reach out to ASIC directly.

If you suspect HighLow has scammed you, take action. Contact us for a free consultation to learn about your alternatives and begin the rehabilitation process.

Visit Lycan Retrieve Facebook Page

Visit Twitter

No comment