Egplus Scam: A Detailed Egplus Review

The Egplus.vip website purports to be a profitable cryptocurrency investment platform that employs sophisticated trading bots and market analysis to provide daily high returns. But is it legitimate? Let’s analyze it in this in-depth Egplus review.

Egplus Broker Overview

- Website: https://egplus.vip/

- Website Availability: Yes

- Address: NA

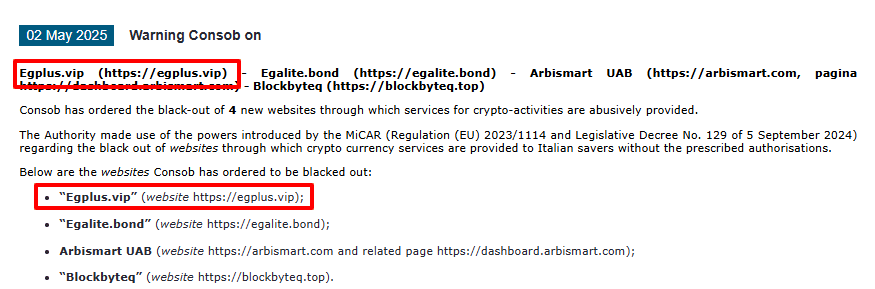

- Warning Notices: Commissione Nazionale per le Società e la Borsa (Italy)

- Check CONSOB Warning – https://www.consob.it/web/consob-and-its-activities/warnings/latests

- Domain Blacklisted Status: It seems there is no direct mention of this domain being on a blacklist.

Unrealistic Return Promises

- Guaranteed Daily Returns: Egplus.vip pays investors 5% to 10% daily returns. In real life, such constant returns are realistically impossible, especially in the volatile crypto markets. Genuine investment platforms never promise returns.

- Too Good to Be True: Most of these threats are commonly used by malicious platforms to lure unsuspecting individuals. Always consider guaranteed high returns to be a warning sign.

Lack of Transparency

- No Transparent Plan: Egplus does not make it clear what precisely its trading robots do. No description of the algorithms, risk management, or trading counterparts is given. Investors are to take unsubstantiated claims at face value without proof.

- Company Detail Concealment: Legit companies usually have open registration data and an actual office location. Egplus.vip does not have either. It hides with glamorous advertisements but fails to reveal who owns or runs the platform.

Regulatory Warning

- Warning issued by CONSOB: CONSOB, which is Italy’s financial watchdog, already issued a warning on Egplus.vip. Consequently, the site is not licensed to provide investment services within regulated markets. Warnings by such authorities mean that investors should be cautious.

Egplus Review: Final Remarks

In short, the Egplus review shows a few red flags: unrealistic investment returns, lack of transparency, and a regulatory warning. All these points towards one conclusion: Egplus.vip cannot be trusted with your money. It is wise to avoid this website and instead seek alternative, safer, regulated means of investment.

Frequently Asked Questions (FAQs)

1. Is Egplus a regulated broker?

No. Egplus is not regulated by any recognized financial authority. Several regulators, including CONSOB in Italy, have even issued warnings against it.

2. Can I trust Egplus with my money?

It’s risky. Egplus makes big promises but lacks transparency about its owners, location, and legal status. Without regulation, your funds are not protected.

3. How does Egplus claim to make profits?

Egplus claims to use “advanced trading bots” to generate daily returns. However, there is no verified proof that these bots exist or work as advertised.

4. Are withdrawals from Egplus guaranteed?

No. Many unregulated brokers restrict or block withdrawals once users deposit larger amounts. Reports suggest that users face difficulties withdrawing funds.

5. What are the red flags with Egplus?

- No regulation or valid license

- Anonymous ownership

- Unrealistic profit promises

- Regulatory warnings

- Lack of transparency in trading terms

6. What should I do if I already invested in Egplus?

Stop depositing more funds immediately. Document all communications, screenshots, and transactions. Then, contact a fund recovery or cybercrime support service for help.

7. What are safer alternatives to Egplus?

If you want to trade, choose brokers regulated by authorities like FCA (UK), CySEC (Cyprus), or ASIC (Australia). These platforms offer better protection, transparency, and dispute resolution.

8. Can Egplus be a scam?

Yes, all signs point toward Egplus being a high-risk platform that may be operating as a scam. It’s best to avoid investing.

Warning Signs to Watch Out For

- Unverified Licensing: A legitimate broker must show its regulatory license and registration number.

- High-Pressure Sales Techniques: Threats to make a quick deposit or promises of surefire returns are typical of a scam.

- Unclear Business Practices: Brokers who won’t give information about operations, management, or financial policies are probably not to be trusted.

Protecting Yourself as an Investor

To remain secure while selecting a broker, follow these best practices:

- Independent Research: Search for neutral reviews, regulatory information, and user feedback.

- Regulatory Check: Ensure that the broker is regulated by a known authority.

- Avoid Guaranteed Deals: Watch out for brokers promising guaranteed returns or bonus plans.

- Regular Check-ups: Regularly monitor your accounts and respond at once to suspicious transactions.

Need Help? We’re Here to Assist

If you’ve lost money to Egplus or any other similar broker, you’re not alone. Contact us to our recovery team today for a free consultation. We can review your case and recommend the best course of action.

Lycan Retrieve – Trust. Transparency. Results.

Let us be your guide on your journey to retrieve what’s yours.

Get in touch right now to regain financial control.