Founded in 2021, Ventezo claims to provide forex, commodities, and crypto trading with high leverage and the lowest barriers to entry. Despite the marketing plume of being a highly competitive broker, the growing complaints of clients tell a different story. The trading environment that was said to be fair and profitable at the outset has now turned into serious allegations of manipulation, hidden fees, and denial of payments.

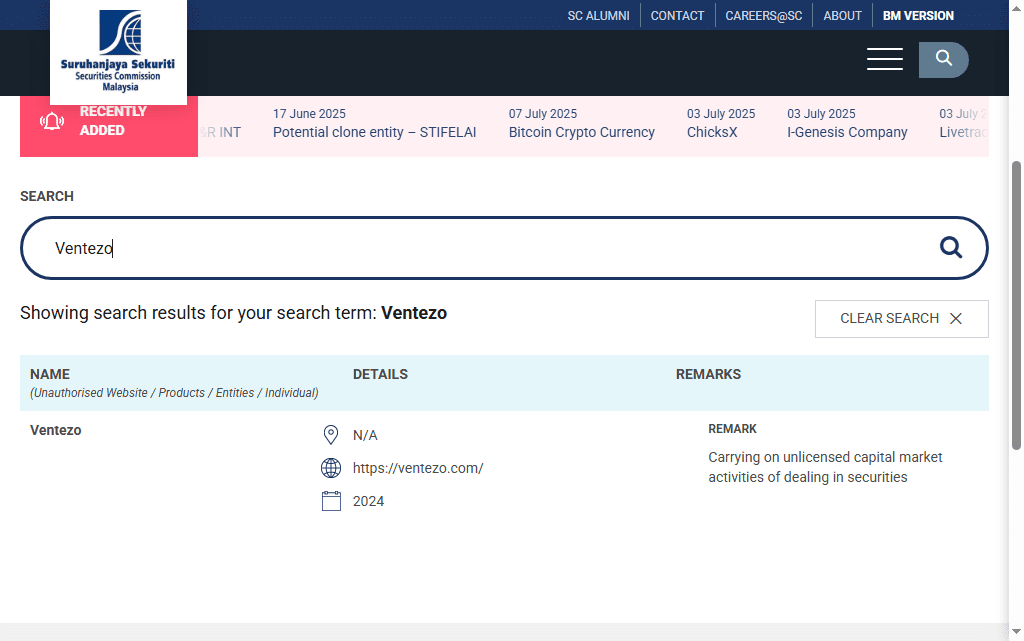

Regulatory Warning from Malaysia’s Securities Commission

Further degrading its credibility is the fact that Ventezo has been officially warned by the Securities Commission Malaysia (SC). The warning implies that Ventezo is carrying out unlicensed capital market activities and offering investment services without registering with the said body. Such a red flag from a national regulatory body is a confirmation of the mounting concern shared by users about the potential risks of dealing with this platform.

Some Red Flags Raised

There have been horrid incidents reported by several traders. After one trader successfully passed a proprietary trading challenge and was declared funded, he allegedly never received the agreed-upon share of profits, even though a full week went by after the withdrawal.

Lack of Transparency

Arguably, the most concerning issue with Ventezo is the lack of transparency. It provides almost no information related to its founders or operational team. There is no proof that Ventezo has a financial regulation license from any legitimate regulatory authority.

Questions and Answers

Q1: Is Ventezo a regulated broker?

No, Ventezo has failed to present any verifiable regulatory credentials from recognized financial authorities.

Q2: What are the usual complaints received about Ventezo?

Traders have complained about withheld profits, retroactive fees, the absence of support, and the manipulation of their accounts.

Q3: How do I get my money back from Ventezo?

While difficult, the victim may do the right thing by documenting all communication and reporting the incident to the financial regulators or consulting recovery agencies for fraud.

Q4: Why is swap-free trading a problem?

Apparently, Ventezo retroactively imposed swap fees some months after profits had been booked, thus erasing client earnings.

Q5: Does Ventezo disclose its ownership?

No. Silence from the platform on matters of ownership only increases suspicion about its credibility.

Take Action Today

Don’t wait if you’ve been deceived by Ventezo. To discuss your options and begin your recovery process, contact us for a free consultation. Your financial security is important, and being proactive can help protect it.

At Lycan Retrieve, we work to restore your losses and deliver results. Contact us now to regain management of your finances.

Visit Lycan Retrieve Facebook Page

Visit Twitter