Trustfxpro Review – Is Trustfxpro a Scam?

Numerous traders have inquired recently about the legitimacy of Trustfxpro. This Trustfxpro review describes why it’s prudent to exercise caution before investing money with this broker.

Trustfxpro Broker Overview

- Website: https://www.trustfxpro.com/

- Website Availability: Yes

- Address: 127 HOLMES AVENUE, HUNTSVILLE, AL 35802, Jl. , USA

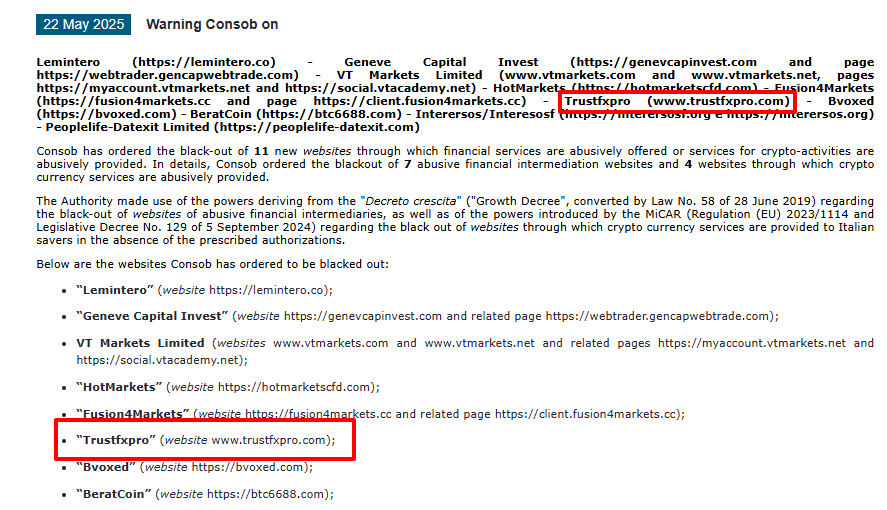

- Warning Notices: Commissione Nazionale per le Società e la Borsa (Italy)

- Check CONSOB Warning – https://www.consob.it/web/consob-and-its-activities/warnings/latests

- Domain Blacklisted Status: It seems there is no direct mention of this domain being on a blacklist.

Red Flags Found in Trustfxpro

1. Fake Location Claims:

Trustfxpro boasts an office in the United States. However, there is no record of this broker as per an investigation by the National Futures Association (NFA). This non-registration is a strong warning indicator that it does not have approval to provide trading services in the US.

2. Regulatory Actions:

Regulators such as the Italian Commissione Nazionale per le Società e la Borsa (CONSOB) have blacklisted websites with the same scam templates. CONSOB has compelled Trustfxpro, another similar scam site, to close down for offering illegal financial services. Trustfxpro appears to operate the same way, exposing traders’ funds to risks.

3. Website is Inactive:

Now, the Trustfxpro site is currently not accessible. This instantaneous absence is typical for scam brokers who disappear after collecting sufficient deposits from naive traders.

Why You Should Ignore Trustfxpro?

- Unlicensed broker: Lack of legal sanction by reliable regulators.

- False reports: Bogus office information to look credible.

- Previous scam template: Comparable to other websites reported to be fraudulent.

- No customer support: After the site crashes, it’s impossible to recoup money with ease.

Final Verdict on Trustfxpro

This Trustfxpro review exhibits that trading with this broker is extremely risky. There are several indicators that it is a scam. Traders need to remain vigilant and not send money to unlicensed sites. Always look for authentic regulatory licenses and read unbiased reviews before putting funds into any online platform.

FAQ — Trustfxpro

1. Is Trustfxpro a scam or legit broker?

Trustfxpro shows multiple red flags like fake address, no license, and regulator warnings. It’s not safe to trust.

2. Is Trustfxpro regulated?

No. Trustfxpro is not registered with any trusted financial authority.

3. Can traders withdraw money from Trustfxpro?

No verified reports of successful withdrawals exist. The site is inactive, making withdrawals unlikely.

4. What are the warning signs of Trustfxpro?

- Fake location claims

- No regulation

- CONSOB warning

- Website shut down

- High-pressure deposit tactics

5. How can I recover money lost to Trustfxpro?

- Report to your bank and regulator

- Gather proof of transactions

- Avoid further deposits

- Seek help from a trusted recovery service

Warning Signs to Watch Out For

- Unverified Licensing: A legitimate broker must show its regulatory license and registration number.

- High-Pressure Sales Techniques: Threats to make a quick deposit or promises of surefire returns are typical of a scam.

- Unclear Business Practices: Brokers who won’t give information about operations, management, or financial policies are probably not to be trusted.

Protecting Yourself as an Investor

To remain secure while selecting a broker, follow these best practices:

- Independent Research: Search for neutral reviews, regulatory information, and user feedback.

- Regulatory Check: Ensure that the broker is regulated by a known authority.

- Avoid Guaranteed Deals: Watch out for brokers promising guaranteed returns or bonus plans.

- Regular Check-ups: Regularly monitor your accounts and respond at once to suspicious transactions.

Need Help? We’re Here to Assist

If you’ve lost money to Trustfxpro or any other similar broker, you’re not alone. Contact us to our recovery team today for a free consultation. We can review your case and recommend the best course of action.

Lycan Retrieve – Trust. Transparency. Results.

Let us be your guide on your journey to retrieve what’s yours.

Get in touch right now to regain financial control.