Summary:

First Nexus raises several concerns. There are questions regarding its legitimacy because it is not registered with the BC Securities Commission. Many users have reported bad experiences, which contributes to the low Trustpilot ratings. Delays in responding, aggressive follow-up calls with fictitious London numbers, and pressure to pay more are among the complaints. According to some users, First Nexus never fulfilled their unrealistic returns promises, such as £8,000 per month. Others reported that even after blocking the business, they continued to receive calls. All of these patterns point to fraudulent conduct.

Is First Nexus a Legitimate Broker or a Potential Scam?

Considering investing with First Nexus? Before you do, you should consider whether this broker is safe or dangerous to your funds. This review provides significant concerns about First Nexus, including regulatory status, operating transparency, and potential red flags that will shape your decision.

First Nexus Broker Overview

- Website: https://firstnexus.org

- Website Availability: Yes

- Address: 128 CITY ROAD LONDON UNITED KINGDOM EC1V 2NX

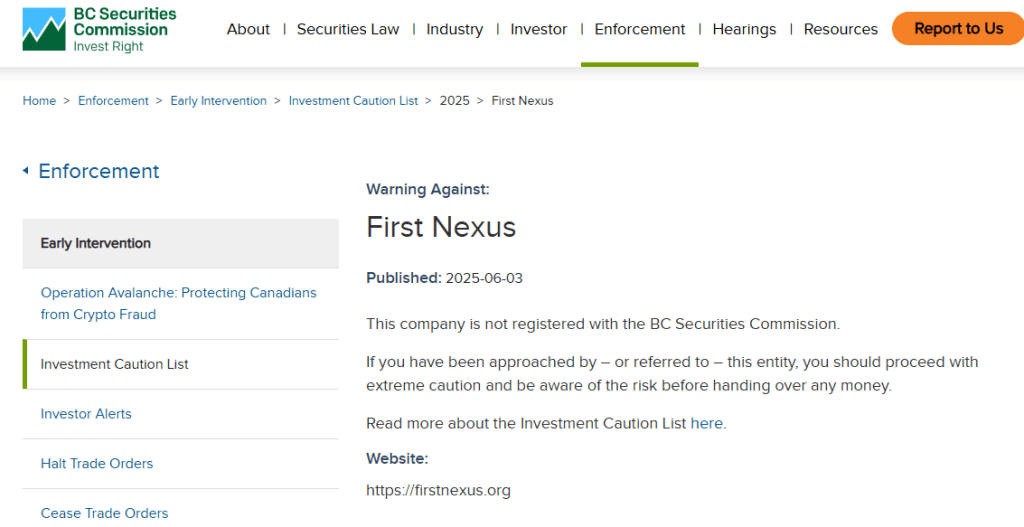

- Warning Notices: British Columbia Securities Commission (British Columbia)

- Check BCSC Warning – https://www.bcsc.bc.ca/enforcement/early-intervention/investment-caution-list/2025/first-nexus

- Domain Blacklisted Status: The domain firstnexus.org has been flagged on 1 of 70 known blacklists, indicating potential security or reputation concerns.

Primary Concerns About First Nexus

1. Customer Complaints and Reports

Numerous users complained about First Nexus because of the following persistent problems:

- Delayed Withdrawals: Users report long delays when withdrawing money.

- Hidden Charges: Secret fees are being charged without prior notification.

- Account Access Restrictions: Instances of accounts being frozen or denied access upon deposits.

2. Regulatory and Licensing Issues

Before trading with any broker, it is essential to verify whether it is regulated by a reputable financial authority. In First Nexus’s case:

- Regulation Status: No confirmed license from a leading regulatory agency, such as the SEC (USA), ASIC (Australia), or FCA (UK).

- Lack of Transparency: Uncertainty is increased by a lack of information regarding ownership or the organization’s structure.

Warning Signs to Watch Out For

- Unverified Licensing: A legitimate broker must show its regulatory license and registration number.

- High-Pressure Sales Techniques: Threats to make a quick deposit or promises of surefire returns are typical of a scam.

- Unclear Business Practices: Brokers who won’t give information about operations, management, or financial policies are probably not to be trusted.

Protecting Yourself as an Investor

To remain secure while selecting a broker, follow these best practices:

- Independent Research: Search for neutral reviews, regulatory information, and user feedback.

- Regulatory Check: Ensure that the broker is regulated by a known authority.

- Avoid Guaranteed Deals: Watch out for brokers promising guaranteed returns or bonus plans.

- Regular Check-ups: Regularly monitor your accounts and respond at once to suspicious transactions.

Steps to Recover Lost Funds

If you’ve had issues with First Nexus or suspect fraud, here’s what you can do:

- Report to Authorities: Report the incident to the respective financial regulator.

- Consult Recovery Experts: Expert advice can help navigate the recovery process.

- Document Everything: Keep a thorough record of all conversations, exchanges, and emails.

Need Help? We’re Here to Assist

If you’ve lost money to First Nexus or any other similar broker, you’re not alone. Contact us to our recovery team today for a free consultation. We can review your case and recommend the best course of action.

Lycan Retrieve – Trust. Transparency. Results.

Let us be your guide on your journey to retrieve what’s yours.

Get in touch right now to regain financial control.