The cryptocurrency market is a fast-moving, high-opportunity space, but it’s also rife with unregulated operators who prey on unsuspecting traders. DigiFinex is one such name that frequently pops up in both promotional materials and complaint forums. Launched in 2017 and headquartered in Singapore, the platform claims to have over 6.4 million traders and offers access to over 700 cryptocurrencies, derivatives, staking, and other trading services.

At first glance, DigiFinex’s wide asset selection, competitive fees, and mobile-friendly platform may seem appealing. But when you dig deeper, a different picture emerges — one filled with regulatory ambiguity, withdrawal complaints, and troubling customer experiences.

This review examines DigiFinex from all angles — what it offers, the red flags you should be aware of, and whether you should trust it with your funds.

Overview of DigiFinex

DigiFinex presents itself as a global cryptocurrency trading platform catering to both novice and professional traders. Its main features include:

- User-friendly interface with basic and advanced charting tools.

- Low transaction fees compared to some competitors.

- Mobile app accessibility for Android and iOS.

- Access to spot, futures, and margin trading.

- Staking services for earning rewards.

- Crypto-backed loans and ETF products.

The exchange also claims to partner with various financial and technology providers to offer exclusive promotions, such as reduced trading fees and early access to new crypto listings.

The Good Side – Claimed Advantages

DigiFinex markets itself with several selling points:

- Wide range of cryptocurrencies: Over 700 assets, including BTC, ETH, LTC, XRP, BCH, and LINK.

- Competitive trading fees: Attractive to high-frequency traders.

- High liquidity: Claims to handle large trade volumes without significant slippage.

- Several payment options, including cryptocurrency deposits, credit/debit cards, and bank transfers.

- Security measures: Cold storage for the majority of assets, two-factor authentication (2FA), and recurring security audits.

While these features can make a platform look legitimate, the question remains — are they enough to outweigh the risk signals?

Red Flags: Is DigiFinex a Scam?

1. Regulatory Status – Unclear and Unverified

The lack of credible regulatory oversight is one of the main issues with DigiFinex. Regulated exchanges prominently display their licenses, company information, and legal documents (terms & conditions, privacy policy, risk disclosures).

DigiFinex provides none of these on its website — no physical office address, no phone number, and no evidence of oversight by a recognized financial authority. This is a major red flag because unregulated brokers can operate without accountability, leaving customers with no legal recourse if things go wrong.

2. Withdrawal Issues – Locked Funds and Excuses

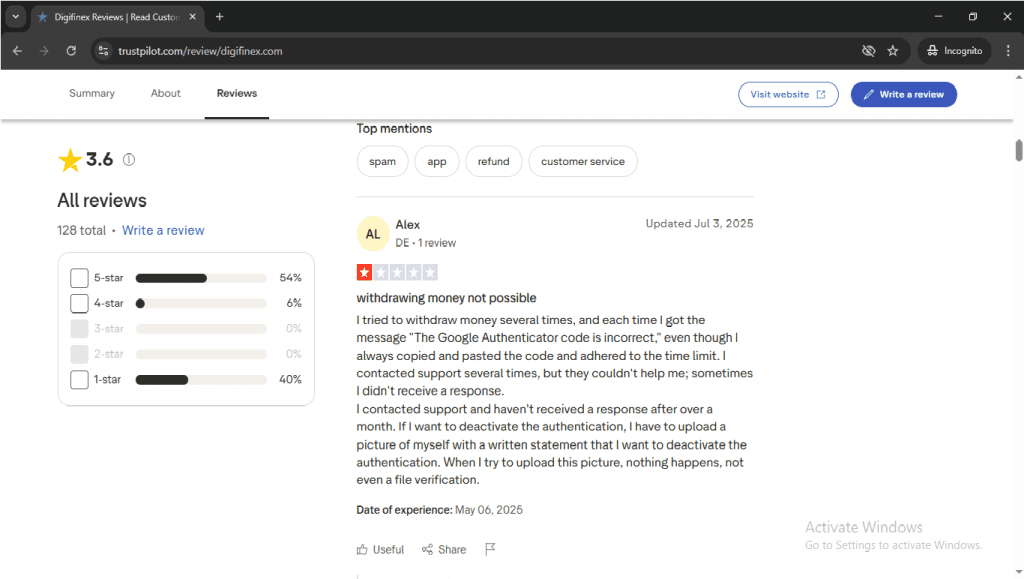

Many traders complain about having trouble getting their money back. The following are among the complaints:

- Withdrawal requests are repeatedly denied without reason.

- Claims that “Google Authenticator codes are incorrect” even when entered correctly.

- Requests for extra verification steps (like uploading a handwritten statement) — but the upload feature fails to work.

- Some withdrawals are never processed, and there are delays of weeks or months.

Such patterns are disturbingly common among scam brokers that want to keep your funds trapped on their platform.

3. Customer Support – Slow or Nonexistent

A trustworthy exchange should have responsive support that resolves issues promptly. DigiFinex, however, receives consistent complaints about:

- Emails are going unanswered for weeks or months.

- Generic, unhelpful replies that don’t solve the problem.

- Support tickets are being closed without resolution.

This lack of customer care is not just inconvenient — it’s a warning sign of a platform that isn’t prioritizing user trust.

User Experiences – What Traders Are Saying

Reports on Trustpilot, Quora, and other forums paint a troubling picture:

- Unexpected account freezes without explanation.

- Verification failures despite providing the requested documents.

- Allegations of price manipulation during periods of high trading volume.

- Withdrawal blocks disguised as “security checks.”

One user’s account of trying to withdraw money sums up the frustration:

“I tried to withdraw several times, but every time I got an error saying my Google Authenticator code was incorrect. Support couldn’t help me, and sometimes didn’t reply at all. When I tried to deactivate authentication, they asked for a photo with a written statement — but the upload page didn’t work.”

Comparing DigiFinex to Reputable Platforms

| Feature | DigiFinex | Binance | Coinbase |

|---|---|---|---|

| Regulation | Unclear | Fully regulated | Fully regulated |

| Withdrawal Speed | Often delayed | Fast | Fast |

| Customer Support | Poor | Excellent | Good |

| Reputation | Negative reviews | Trusted globally | Trusted globally |

The difference is stark — legitimate platforms combine transparency, quick transactions, and accountable service. DigiFinex lacks all three.

Services Offered by DigiFinex

- Spot Trading: Buying and selling crypto instantly.

- Futures Trading: Leverage-based contracts (with high risk).

- Staking: Locking assets to earn passive rewards.

- Margin Trading: Borrowing to amplify trades.

- Crypto-backed Loans: Using holdings as collateral.

While these are standard offerings in the industry, the value is meaningless if users can’t reliably withdraw their profits.

Security Measures – Claims vs. Reality

DigiFinex advertises robust security protocols such as:

- Two-factor authentication (2FA).

- Cold wallet storage for most funds.

- Routine security checks.

However, user complaints suggest that the main problem isn’t hacking or breaches — it’s DigiFinex’s own handling of customer funds and withdrawal requests.

Should You Trust DigiFinex?

Based on the overwhelming number of red flags, the risks far outweigh the rewards. DigiFinex’s unclear regulation, persistent withdrawal issues, poor customer support, and negative reviews across multiple platforms point toward it being an unsafe choice.

Traders are better off choosing exchanges with:

- Clear regulation under recognized authorities.

- Transparent company information.

- Consistently fast withdrawals.

- Responsive support teams.

FAQ

1. What is DigiFinex?

DigiFinex is a cryptocurrency exchange offering spot, margin, and futures trading, along with staking services.

2. Is DigiFinex regulated?

No, DigiFinex is not regulated by any major financial authority.

3. Which cryptocurrencies can I trade on DigiFinex?

You can trade Bitcoin, Ethereum, USDT, and hundreds of altcoins.

4. What are DigiFinex’s fees?

Spot trading fees start at 0.20% and can be reduced for higher trading volumes.

5. Is DigiFinex safe to use?

While it uses security measures like cold storage, the lack of regulation increases risk.

Final Verdict

While DigiFinex offers an impressive range of cryptocurrencies, low fees, and a sleek interface, these positives are overshadowed by serious trust concerns. The platform’s refusal to be transparent about its regulation and the volume of withdrawal-related complaints make it extremely risky.

Consider staying with regulated exchanges with established track records if you value your capital.

Call to Action – Recover Your Money from Scam Brokers

If you’ve lost money to DigiFinex or any other suspicious broker, time is of the essence. Scam platforms use delay tactics to keep your funds locked, but with expert help, recovery is possible. At Lycan Retrieve, we specialize in helping victims reclaim their stolen assets. Our team investigates the broker, gathers evidence, and guides you through proven recovery strategies. Don’t let fraudsters win — Contact us today, start your recovery process, and take the first step toward getting your money back.

Visit Lycan Retrieve Facebook Page

Visit Twitter