ArbiSmart Review: Is It Safe?

ArbiSmart claims to be a safe, EU-licensed wallet and crypto exchange. It markets itself as a platform where users can earn interest on crypto deposits, in addition to providing exchange services for crypto and fiat. But does it live up to its hype? Let’s tear it apart.

ArbiSmart Broker Overview

- Website: https://arbismart.com/

- Website Availability: Yes

- Address: Tornimae 5, 10145 Tallinn, Estonia

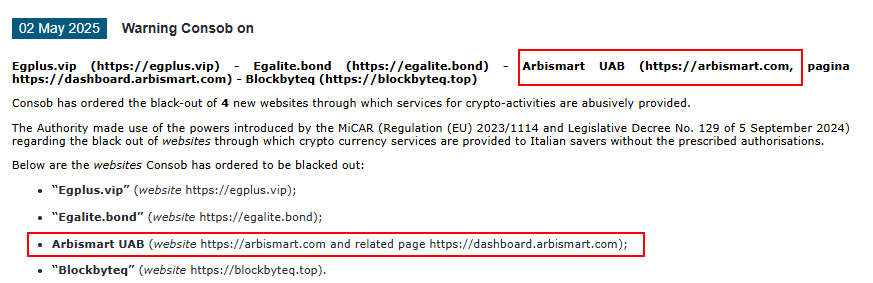

- Warning Notices: Commissione Nazionale per le Società e la Borsa (Italy)

- Check CONSOB Warning – https://www.consob.it/web/consob-and-its-activities/warnings/latests

- Domain Blacklisted Status: It seems there is no direct mention of this domain being on a blacklist.

Negative Customer Experiences

Trustpilot reports that ArbiSmart has a very poor rating of 1.8 stars, and the majority of customer reviews have disappointing tales.

Key complaints include:

- Withdrawal Problems: Most customers report that it’s easy to put money in but very difficult to withdraw money. Some say they have never been able to get their money out.

- Loss in Token Value: Investors have suffered enormous losses as a result of the local RBIS token’s sharp decline in value, which has seen it fall from EUR 120 to EUR 0.015.

- High Fees: It becomes even more challenging to withdraw the remaining funds when users question why withdrawal fees are so high.

- Bad Customer Support: Most people complain that customer support is not helpful or doesn’t reply.

Lack of Transparency

- Customers report that information on who owns or operates ArbiSmart is extremely limited. This is a huge issue of trust.

- There is no concrete proof that true arbitrage trading is taking place. Some assert there are no genuine profits being earned.

Warning Signs

- A few customers have branded the platform as a scam point-blank.

- CONSOB has warned against this broker, according to reports.

- Most of the reviews include phantom positive comments attempting to deceive new investors.

Conclusion

This ArbiSmart review reveals a platform surrounded by unfavorable comments and significant worries, as evidenced by the large number of user reports and the low Trustpilot score. Do your homework and give it some serious thought before investing any money.

FAQs – ArbiSmart

1. Is ArbiSmart regulated?

No. It claims EU licensing but was banned by Italy’s CONSOB for offering unauthorized services.

2. How does ArbiSmart work?

It uses automated crypto arbitrage and RBIS tokens, promising daily returns up to 1%.

3. Can I withdraw my money?

Many users report withdrawal problems and unresponsive support.

4. Has ArbiSmart faced legal action?

Yes. Its websites were blocked by CONSOB in Italy for illegal crypto services.

5. Should I invest?

It’s high-risk. Consider regulated alternatives and research carefully.

Warning Signs to Watch Out For

- Unverified Licensing: A legitimate broker must show its regulatory license and registration number.

- High-Pressure Sales Techniques: Threats to make a quick deposit or promises of surefire returns are typical of a scam.

- Unclear Business Practices: Brokers who won’t give information about operations, management, or financial policies are probably not to be trusted.

Protecting Yourself as an Investor

To remain secure while selecting a broker, follow these best practices:

- Independent Research: Search for neutral reviews, regulatory information, and user feedback.

- Regulatory Check: Ensure that the broker is regulated by a known authority.

- Avoid Guaranteed Deals: Watch out for brokers promising guaranteed returns or bonus plans.

- Regular Check-ups: Regularly monitor your accounts and respond at once to suspicious transactions.

Need Help? We’re Here to Assist

If you’ve lost money to ArbiSmart or any other similar broker, you’re not alone. Contact us to our recovery team today for a free consultation. We can review your case and recommend the best course of action.

Lycan Retrieve – Trust. Transparency. Results.

Let us be your guide on your journey to retrieve what’s yours.

Get in touch right now to regain financial control.