Is Lemintero a Legitimate Broker or a Potential Scam?

Considering investing with Lemintero? Before you do, you should consider whether this broker is safe or dangerous to your funds. This review provides significant concerns about Lemintero, including regulatory status, operating transparency, and potential red flags that will shape your decision.

Lemintero Overview

- Website: https://www.lemintero.com/

- Website Availability: Yes

- Address: 30 Churchill Pl, London E14 5EU, United Kingdom

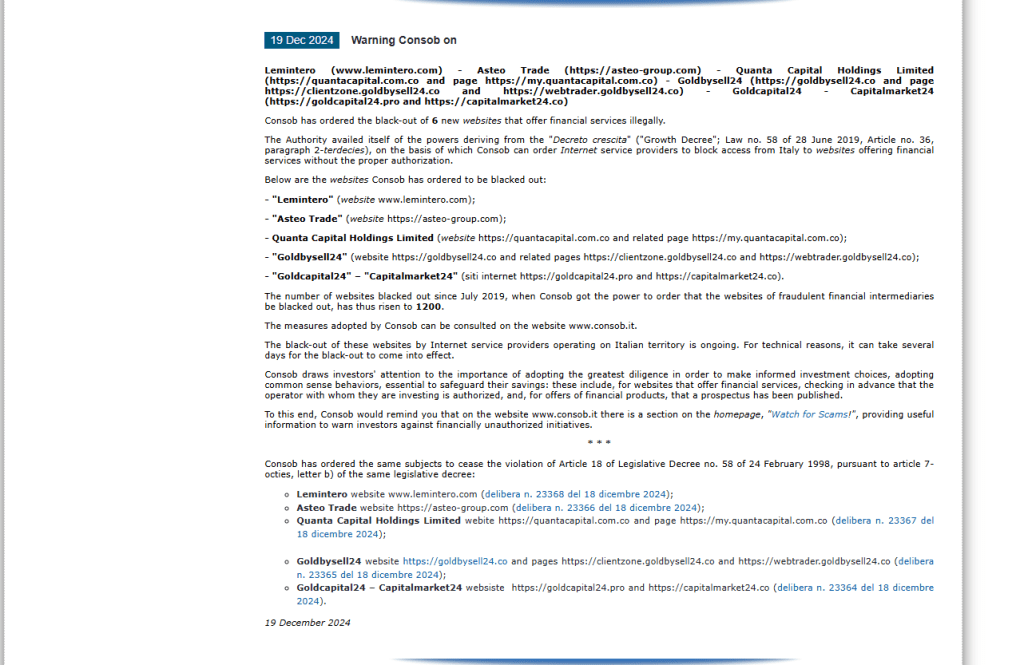

- Warning Notices: Commissione Nazionale per le Società e la Borsa (Italy) – (CONSOB)

- Domain Blacklisted Status: It seems there is no direct mention of this domain being on a blacklist.

Lemintero has come under serious scrutiny after the Italian Companies and Exchange Commission (CONSOB) issued a warning and ordered its website to be blacked out on May 22, 2025, for offering financial services illegally. The broker claims to be based in the UK, but a search in the Financial Conduct Authority (FCA) registry found no records, confirming that Lemintero is not regulated by any trusted authority.

With a Trustscore of just 11/100, a low Tranco rank, and a very young domain age, the platform shows several hallmarks of a scam. Despite being new, it has a suspiciously high number of negative reviews, with a 1.8 “Poor” rating on Trustpilot, where most users report bad experiences.

The lack of transparency, absence of valid regulation, and regulatory warnings make Lemintero extremely unsafe. Investors should treat this broker as a potential scam and avoid risking their funds.

Primary Concerns About Lemintero

1. Customer Complaints and Reports

Numerous users complained about Lemintero because of the following persistent problems:

- Delayed Withdrawals: Users report long delays when withdrawing money.

- Hidden Charges: Secret fees are being charged without prior notification.

- Account Access Restrictions: Instances of accounts being frozen or denied access upon deposits.

2. Regulatory and Licensing Issues

Before trading with any broker, it is essential to verify whether it is regulated by a reputable financial authority. In Lemintero’s case:

- Regulation Status: No confirmed license from a leading regulatory agency, such as the SEC (USA), ASIC (Australia), or FCA (UK).

- Lack of Transparency: Uncertainty is increased by a lack of information regarding ownership or the organization’s structure.

Warning Signs to Watch Out For

- Unverified Licensing: A legitimate broker must show its regulatory license and registration number.

- High-Pressure Sales Techniques: Threats to make a quick deposit or promises of surefire returns are typical of a scam.

- Unclear Business Practices: Brokers who won’t give information about operations, management, or financial policies are probably not to be trusted.

Protecting Yourself as an Investor

To remain secure while selecting a broker, follow these best practices:

- Independent Research: Search for neutral reviews, regulatory information, and user feedback.

- Regulatory Check: Ensure that the broker is regulated by a known authority.

- Avoid Guaranteed Deals: Watch out for brokers promising guaranteed returns or bonus plans.

- Regular Check-ups: Regularly monitor your accounts and respond at once to suspicious transactions.

Steps to Recover Lost Funds

If you’ve had issues with Lemintero or suspect fraud, here’s what you can do:

- Report to Authorities: Report the incident to the respective financial regulator.

- Consult Recovery Experts: Expert advice can help navigate the recovery process.

- Document Everything: Keep a thorough record of all conversations, exchanges, and emails.

Need Help? We’re Here to Assist

If you’ve lost money to Lemintero or any other similar broker, you’re not alone. Contact us to our recovery team today for a free consultation. We can review your case and recommend the best course of action.

Lycan Retrieve – Trust. Transparency. Results.

Let us be your guide on your journey to retrieve what’s yours.

Get in touch right now to regain financial control.