Oak Hill Capital Partners markets itself as a professional investment firm providing high-return financial commission services. However, a number of investor complaints and red flags suggest it’s a scam operation. It shelters behind a facade of credibility and is exploiting investor trust, which has devastated many individuals financially.

Warnings

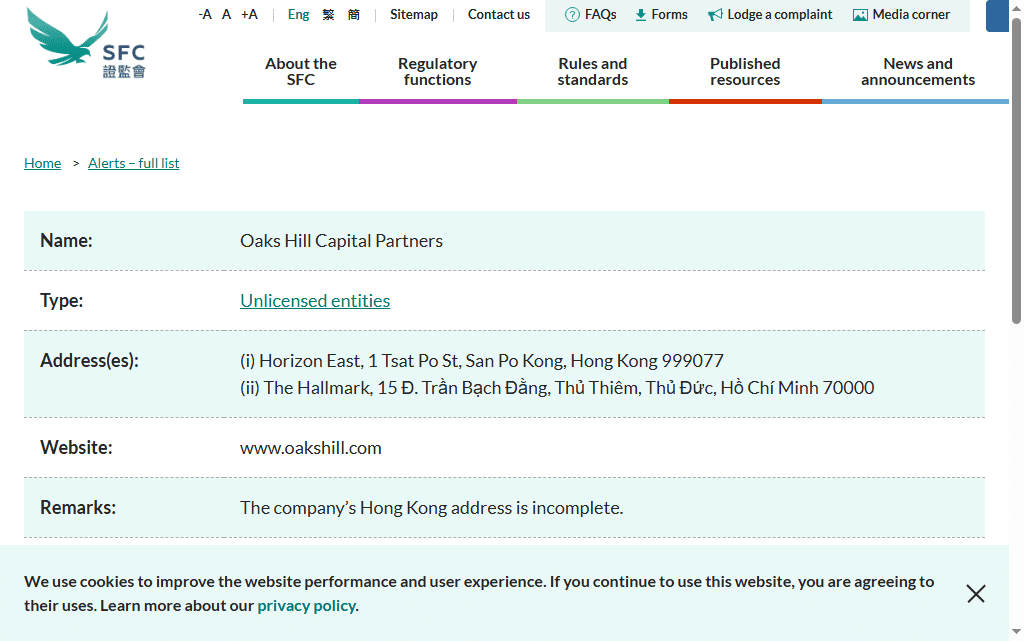

The Hong Kong Securities and Futures Commission (SFC) recently issued a formal warning to Oak Hill Capital Partners when the SFC discovered that the broker was providing regulated financial services without authorization. The SFC’s warning raises very serious questions about the brokers’ validity and how they conduct themselves. When a broker is issued a warning from a regulatory authority it is deeply concerning. This should be noted as a red flag for potential customers or investors as Oak Hill Capital Partners may not be acting legally in relation to its regulated financial services.

Technical Red Flags

- The site’s traffic is low and uses shared hosting with multiple other low-rated and suspicious websites.

- The registrar is common for fraudulent platforms.

- Oak Hill Capital Partners appears to be using offshore hosting and has no licensing information at this time.

Q: Is Oak Hill Capital Partners a Legitimate Company?

The ambiguous regulatory status, the reported alleged complaints from users, and the shady nature of their business practices demonstrate that Oak Hill Capital Partners is not a legitimate financial service. This fits the mold of an investment scam that will defraud users and disappear.

Q: Is Oak Hill Capital Partners a regulated investment company?

No. Oak Hill Capital Partners does not have registration with a financial regulatory body; thus, they are not operating legally.

Q: Why is Oak Hill Capital Partners a fraud?

Users report an inability to withdraw, misleading information, and asking for the user to deposit more money without a logical reason. All are either legal indicators of scam behavior.

Q: Can I get my money back from Oak Hill Capital Partners?

Maybe! You should consider contacting a scam recovery service, and document everything you can from your documents regarding the event and transactions.

Q: How do they trick people into investing?

They use business words, fake testimonials, and promise improbable returns as bait to get users. Once the person deposits the money, communication stops.

Take Action Today

Don’t wait if you’ve been deceived by Oak Hill Capital Partners. To discuss your options and begin your recovery process, contact us for a free consultation. Your financial security is important, and being proactive can help protect it.

At Lycan Retrieve, we work to restore your losses and deliver results. Contact us now to regain management of your finances.

Visit Lycan Retrieve Facebook Page

Visit Twitter